I honestly did not have much confidence in the intent of the SC Expert Committee report, yet since there were some eminent names such as Supreme Court judge Justice AM Sapre, OP Bhatt, KV Kamath and Nandan Nilekani, there was reason to believe the report must have substance. But the first few paras of the report will take the wind out of ones’ sails.

The report starts by saying that the committee was constituted at the behest of the Honourable Supreme Court at the back of the writ petitions filed post Hindenburg in order to determine:

a. Whether there has been violation of Rule 19A of the Securities contract, (which lays down limits of minimum offer and allotment to the public, in this case its 25%)

b. Whether there has been a failure to disclose transactions with related parties and other relevant information which concerns related parties, to SEBI, in accordance with law

c. Whether there was any manipulation of stock prices in contravention of existing laws.

Page 1 | Para 2: Report of the Expert Committee

This report does not address any of the above, instead the objective of the committee was to investigate and:

a. To provide an overall assessment of the situation including the relevant causal factors which led to the volaitility in the securities market in the recent past;

b. To suggest measures to strengthen investor awareness

c. To investigate whether there has been regulatory failure in sealed with the alleged contravention of laws pertaining to the securities market in relation to the Adani Group or other companies

d. To suggest measures to:-

i. strengthen the statutory and/or regulatory framework; and

ii. secure compliance with the existing framework for the protection of investors

Page 2 | Para 3: Report of the Expert Committee

Wait a minute! What happened to circular trades to inflate stock price? What about tax evasion? What about money laundering? What about round tripping of invoices? What about accounting fraud? Sorry to dissapoint , this committee was never meant to investigate the Hindenburg allegations nor the issues raised in the writ petition.

It rather reads like this committee was setup to address the effectiveness of the regulator. So I am a bit confounded as to how Hindu concluded there was a clean chit from SC panel and the fact the stock gained 19%, doesn’t inspire much confidence in the quality of the equity research.

The frequent usage of the word “investigation” in this report is a bit of a misnomer, I would rather generously call it analysis. And unfortunately the analysis are of some inconsequential and some (dare I say) irrelevant events with regards to the egregious issues raised in the Hindenburg report. For e.g. if we were to understand the circular trade allegation, I would look at the rally that lead to the Adani Group PE rising from 15.09 to 214.45 between 2021 to 2022, as I had quoted Damodaran’s analysis in my first blog. Instead the report evaluates the sequence of events post Hindenburg report between 24 January 2023 and 28 March 2023 and its impact in the form of losses to the wider market. This is like describing the circus next to the crime scene in detail as against the events leading to the crime. In other words, this was never the problem, in fact the Hindenburg report alleged more than 75% of the stock was held by the promoter, so if anyone loses from the fall in share price its the promoter and not the wider market.

There are large sections of the report evaluating the effectiveness of SEBI’s monitoring framework and one para even included an investopedia definition of what is volatility. Mostly there are pages of content akin to a high school research paper. The section where I was hoping for some in-depth “investigation” was the section titled “Alleged Contraventions and Regulatory Failure”.

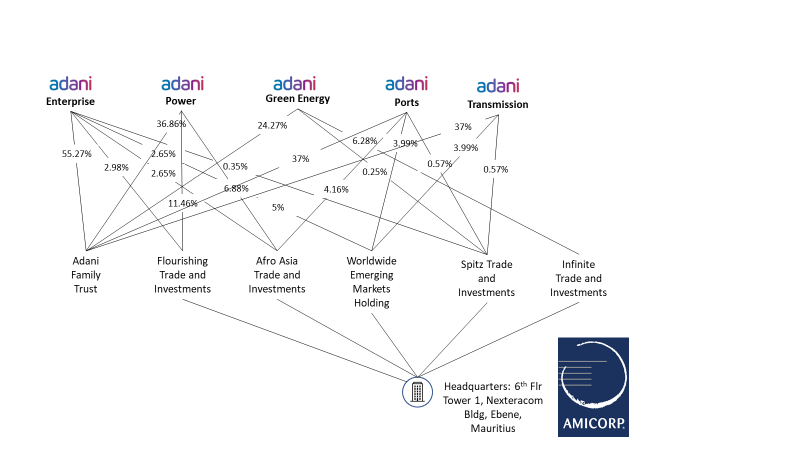

But before we dive in, I would like to remind the reader of this image I created in the first blog, which I have republished for easy reference.

Figure 1: Mauritius shell entities and their holdings in Adani

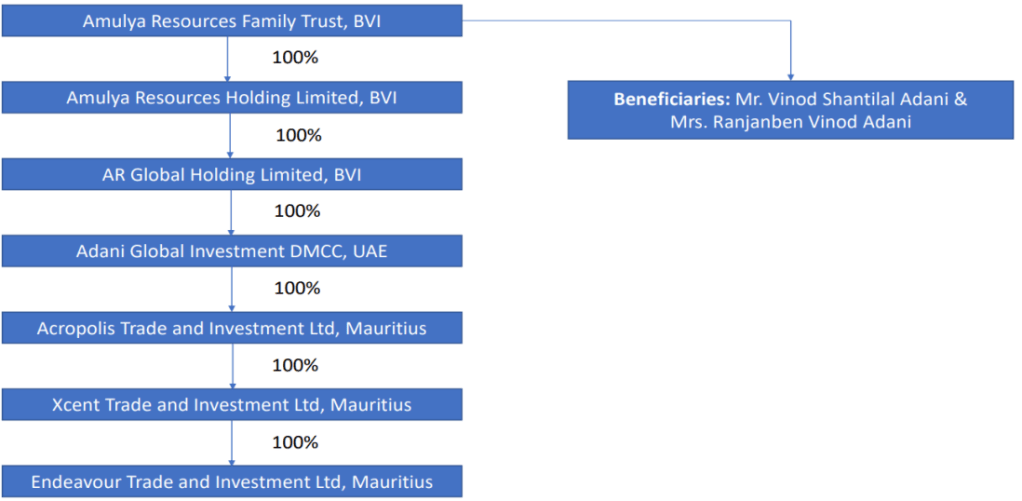

I would also like to recall the image extracted from the SEBI offer document published in my second blog.

Figure 2: Ambuja Cement acquirer ownership structure

In the Expert Committee report, SEBI has listed all the FPI holding in Adani entities in Table 1 and 13 FPIs and their beneficiaries in Table 2. The SEBI report states that “The collective holding of these 13 overseas entities in the six Adani listed companies between 2017 and 2020 has been summarised in the table below:-“

| Company | FPI shareholding 2017 (%) | FPI Shareholding 2018 (%) | FPI shareholding 2019 (%) | FPI shareholding 2020 (%) |

| Adani Enterprises Limited | 12.87 | 16.91 | 14.96 | 15.56 |

| Adani Transmission Limited | 14.58 | 17.99 | 17.13 | 18.5 |

| Adani Total Gas Limited | 18.62 | 17.91 | ||

| Adani Green Energy Limited | 9.54 | 20.39 | ||

| Adan Ports and Special Economic Zone Ltd. | 6.53 | |||

| Adani Power Ltd. | 17.11 | 13.64 | 12.21 | 14.11 |

| # | FPI | Jurisdiction | Controlling shareholder | Name of BO declared | Nationality/ Country of operation of BO |

| 1 | Elara India Opportunities Fund | Mauritius | Marshall Advisors Limited – held 100% by Lumen Capital Fund Pte Ltd | Mr. Rajendra Bhatt | UK |

| 2 | Vespera Fund Limited | Mauritius | Clara Asset Management Ltd held 100% by Elara Capital PLC | Mr. Rajendra Bhatt | UK |

| 3 | Marshal Global Capital Fund Limited | Mauritius | Marshall Advisors Limited – held 100% by Lumen Capital Fund Pte Ltd | Mr. Nuni Venkata Ramana Murty | Singapore |

| 4 | Emerging India Focus Funds | Mauritius | Emerging India Fund Management Ltd- held by the Emerging Fund Trust | Trident Trust Company Limited as trustee of the trust – Mr. Jimmy Ernest as settlor | Mauritius |

| 5 | EM Resurgent Fund | Mauritius | Emerging India Fund Management Ltd- held by the Emerging Fund Trust | Trident Trust Company Limited as trustee of the trust – Mr. Jimmy Ernest as settlor Mauritius | Mauritius |

| 6 | Cresta Fund Limited | Mauritius | Dertona Holdings Ltd. | Mr. Mark Dangel | Switzerland |

| 7 | Albula Fund Limited | Mauritius | Connor Investment Holdings Ltd | Ms. Anna Luzia von Senger Burger | Switzerland |

| 8 | APMS Fund Limited | Mauritius | M.I.H. International Ltd | Mr. Alastair Guggenbuhl-Even Mrs. Yonca Guggenbuhl | Switzerland |

| 9 | LTS Investment Fund Ltd. | Mauritius | Helvetic Capital Management Ltd | Mr. Alastair Guggenbuhl-Even | Switzerland |

| 10 | Asia Investment Corporation Limited | Mauritius | M.I.H. International Ltd | Mr. Alastair Guggenbuhl-Even Mrs. Yonca Guggenbuhl | Switzerland |

| 11 | Polus Global Fund | Mauritius | Fidelis Global Asset Management Ltd | Mr. Yajadeo Lotun | Mauritius |

| 12 | New Leanna Investments Ltd. | Cyprus | Andetta Private Equity N V | Stitching for Sustainable Development a Dutch Foundation – Mr Jan Scheelings Ms. Margaret Ilse Sjak-Shie, Mr Collin Peter de Wit | Netherlands |

| 13 | Opal Investment Pvt. Ltd | Mauritius | Zenith Commodities General Trading L.L.C. | Mr. Adel Hassan Ahmed Alali | UAE |

The first thing that jumps out, is where are the shell companies from my blog? Flourishing Trade and Investments, Afros Asia Trade and Investments, Worldwide Emerging Markets Holding, Spitz Trade and Investments and Infinite Trade Investments are all completely missing from the report. All these are shell companies registered by the tainted company secretary Amicorp, that was involved in the 1MDB scam. Why has SEBI not listed these FPIs? Why has SEBI not disclosed the name of the entities against their percentage holding in Table 1? Why has SEBI restricted the table data only until 2020? Why was this entire report published in sealed envelope? Apart from the fact this report didn’t contribute anything of value, there is absolutely nothing confidential.

To be fair to SEBI, this is an on going investigation, so this in not really the final outcome. But given the shareholding data is still listed in moneycontrol.com ever since I published it in my last blog, this should require no further “investigation”.

The report further states, “It has been a long-standing suspicion of SEBI that some of the public shareholders are not truly public shareholders they could be fronts for the promotes of these companies”. The report gets more ridiculous, it says, “one could draw a conclusion that the FPIs are fronts for the promotors of the Adani Group”, “to be fair to SEBI it has been investigating this for years before the Hindenburg Report was published” .

Why is this a mere suspicion? And why does SEBI need years to investigate this? Adani declared in the SEBI offer document that Vinod Adani is the ultimate Beneficiary of Endeavour Trade and Investments Ltd, Mauritius (also managed via Amicorp) when they acquired the cement manufacturer Ambuja Cements Ltd. In fact they have taken pains to draw Figure 2 above in their filing.

One wonders why Ambuja Cement was not included in the list of Adani companies investigated in the report? Because then it would have been a bit too obvious isn’t it? Given there are six companies all holding 100% stake in the other, below the chain in between Vinod Adani and Endeavour, it’s conclusive evidence that Adani aims to obfuscate ultimate ownership via front companies.

The report then concludes, if “the FPIS are in fact investing funds for the promoters of Adani Group and therefore could be regarded as a front for the promoters. If such an outcome in the investigation would come about, it would mean the promoters would not be compliant with the minimum publish shareholding”. Given the Endeavour Trade and Investments Ltd’s offer document to acquire Ambuja Cements is sitting in SEBI’s book shelves this should require no further “investigation”. Unless you assume, Adani did a Houdini.