Part 2: Creation of the Adani empire

In a series of blogs, I continue to unravel Adani’s enigmatic rise to becoming the world’s 3rd richest man and within weeks crashing down to being the 17th richest man as a result of a slew of allegations. While in the previous blog I clarified the nature of Adani’s shareholding in its public entities, with specific focus on the offshore holdings, in this blog I hope to bring clarity to the issues with the two Adani acquisitions gathering maximum press ,GVK and Ambuja. One caveat to the reader, I am not a legal expert and lot of what I write is based on publicly available information, both primary and secondary research to which I provide links, so I will let the reader draw their own conclusions based on the facts presented and not have to solely rely on mine. If you don’t have the patience to read the detailed onion peeling, you can jump straight to the conclusion.

GVK Acquisition and the CBI connection

In 2006, a consortium of GVK Industries Ltd, Airports Company South Africa, and Bidvest, won the bid to manage and operate Chatrapati Shivaji Mumbai International Airport. To accomplish this task, Mumbai International Airport Private Limited (MIAL), a joint venture between the consortium (74% holding) and the Airports Authority of India (26%) was formed. Through the consortium GVK held a 50.50% stake in MIAL, the Airports Company of South Africa held a 10% and South African firm Bidvest held 13.5%.

In March 2019, the Adani enters into a share purchase agreement to acquire 13.5% stake of Bidvest for Rs 1,248 crore. However, GVK Group blocked the deal claiming the right of first refusal which the court upheld in November 2019. However, GVK did not have the money to buy Bidvest’s stake. In October that year, the GVK group entered into an agreement with a consortium including the Abu Dhabi Investment Authority, PSP Investments of Canada, and the state-owned National Investment and Infrastructure Fund to sell 79% of its stake in GVK Airport Holdings, which would be used to retire debt obligations and fund purchasing shares of Bidvest and ACSA.

In October 2019, based on an innocuous whistleblower report to the Ministry of Corporate Affairs, headed by the current BJP Finance Minister and Minister of Corporate Affairs Nirmala Sitharaman, ordered the inspection of MIAL’s books. GVK denies any knowledge of a whistleblower report or its allegations.

Soon after in June 2020, CBI filed a case against GVK group alleging financial irregularities to the tune of Rs. 700 crores. The allegation largely was, GVK used Rs. 395 crores from Mumbai International Airports Ltd (MIAL) funds for other group companies.

Soon after in July 2020, enforcement directorate filed a money laundering case probing if genuine funds were laundered to amass personal assets through illegal routing of funds. ED teams conducted searches of the GVK properties including the airport.

In August 2020, GVK Group notifies ADIA consortium about termination of its agreement for acquiring a majority stake in the airport holding company. The agreement between ADIA consortium and the GVK Group’s airport holding company gave the consortium “deal exclusivity” until January 31, 2021. The GVK group went ahead with its takeover deal negotiations with the Adani Group despite the ADIA consortium reportedly flagging India’s Prime Minister’s Office about its existing exclusivity agreement and sending legal notices sighting breach of contract.

In May 2021, ED filed their chargesheet alleging that GVK group Managing Director Sanjay Reddy laundered Rs 500 crores through fictitious transactions. They allege, MIAL had awarded a fake contract of civil work to companies with forged documents. The contacts were never executed but MIAL released the agreed payment. ED alleged that the contractors then transferred the money to GVK group companies or firms associated with its promoters and they laundered the money.

In July 2021, Adani Airport had received approval from the Indian Central Government, the City and Industrial Development Corporation (CIDCO) of Maharashtra, and the Maharashtra government for taking over control of the airport. Following the takeover of Mumbai International Airport, Adani Group became the owner of India’s largest airport infrastructure company. The firm accounts for 25 per cent of all airport footfalls.

In June 2022, a judge has adjourned the trial of 10 GVK Group companies which were being sued by six Indian banks for US$1.5 billion (Rs 12,114 crore) plus interest in the UK high court after hearing the demand for payments could be unlawful since Covid-19 was declared a “force majeure” event in India and the Reserve Bank of India had imposed a moratorium on charging interest during the pandemic.

In January 2023, Central Bureau of Investigation drops corruption charges. CBI informed a special court that no government official was found to be involved in the corruption case registered against the GVK Group and others in connection with the operation and maintenance of MIAL. The CBI said that during investigation, no role of public servants had surfaced, and hence they would not be pressing charges.

ACC and Ambuja acquisition and the Mauritius connection

Adjudicating a price cartel case in 2016, the Competition Commission of India censured cartelization in the cement industry and imposed a penalty of ₹ 6,300 crore on the top 11 cement companies. The top companies that were penalized include Grasim Cements Ltd (now merged with UltraTech), JK Cement, India Cements, Madras Cements, Century Cement, Binani Cement and Lafarge India. CCI imposed a penalty of ₹1,164 crore on Ambuja Cement and another ₹1,148 crore on ACC. Both the companies moved the Competition Appellate Tribunal and, subsequently, the National Company Law Appellate Tribunal, which through its order in July, 2018 dismissed the companies’ appeal and directed the companies to pay the penalty.

In August 2022 the Competition Commission of India (CCI) approved the acquisition of Holcim’s stake in Ambuja Cements Ltd and its subsidiary ACC Ltd by the Adani Group. Adani undertakes all fines. The deal, which was initially entered into by Adani in May this year, will propel the group to become India’s second-largest cement producer. Holcim currently holds a 63.11 per cent share in Ambuja Cements and a 4.48 per cent share in ACC. Furthermore, Ambuja holds a 50.05 per cent stake in ACC.

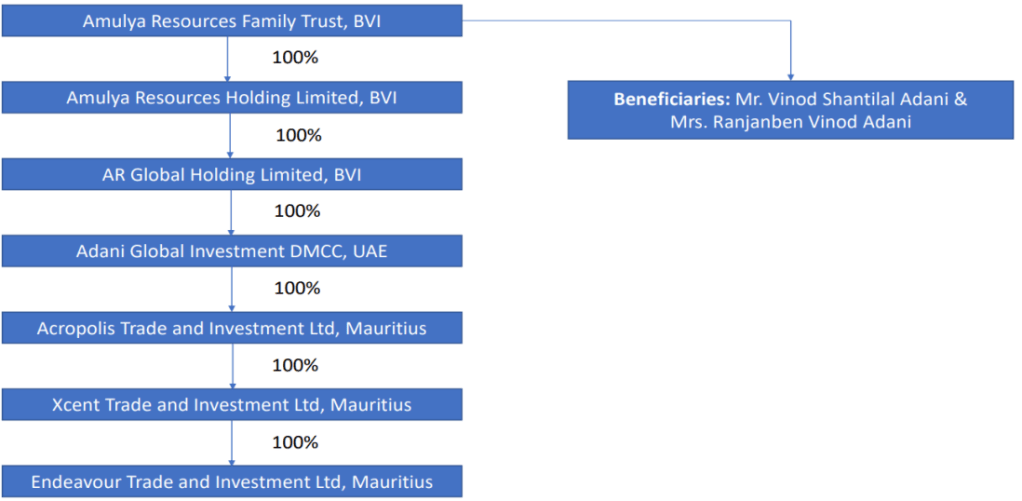

The acquisition will be made by Endeavour Trade and Investments, a newly Mauritius incorporated company, which is owned by Xcent Trade and Investment Ltd (XTIL) according to one article by ICR Newsroom and according to another article by Deccan Herald it is owned by Acropolis Trade and Investment Ltd. Both articles assert that these Mauritius entities are owned by the Adani family, both articles are correct.

All three entities have their registered address and Headquarters listed as 6th Floor, Tower 1, Nexteracom Building, Ebene, MU | Mauritius, in my previous article it was established that the address belongs to Amicorp Mauritius Ltd.

Delving deeper into the open offer document issued by SEBI to unravel yet another Adani mystery, the beneficial ownership structure while common press has stated as unknown is actually quite openly declared.

Adani’s Hindenburg defense stated that “Vinod Adani does not hold any managerial position in any Adani listed entities or their subsidiaries and has no role in their day to day affairs. As such, these questions have no relevance to the entities in the Adani portfolio and we are not in a position to comment on your allegations on the business dealings and transactions of Mr. Vinod Adani. We reiterate that any transactions by the Adani portfolio companies with any related party have been duly identified and disclosed as related party transactions in compliance with Indian laws and standard and have been carried out on arm’s length terms. “. Reference two exhibits below should tell a slightlydifferent story,

The document also publishes details of the related parties in each of the offshore companies:

| Name | Director | Date of Incorporation |

| Xcent Trade and Investment Ltd. Mauritius | Mr. Subir Mittra Mr. Shakill Ahmad Toorabally Mr. Ashwanee Ramsurrun | April 29, 2021 |

| Acropolis Trade and Investment Ltd, Mauritius | Mr. Subir Mittra Mr. Shakill Ahmad Toorabally Mr. Ashwanee Ramsurrun Mr. Vinod Shantilal Adani | April 27, 2017 |

| Adani Global Investment DMCC, UAR | Mr. Subir Mittra Mr. Vinod Shantilal Adani | August 30, 2015 |

| AR Global Holding Ltd., BVI | Mr. Subir Mittra Mr. Vinod Shantilal Adani | May 27, 2015 |

| Amulya Resources Holding Ltd, BVI | Mr. Subir Mittra Mr. Vinod Shantilal Adani | May 27, 2015 |

Wouldn’t acquisition of India’s largest cement manufacturer via Mauritius entities where Vinod Adani and his wife Ranjanben Adani are 100% beneficiaries tantamount to direct relationship as against “arm’s length terms” as per the Adani’s Hindenburg defense?

If Vinod Adani is a director of four of the five intermediate investment entities, in the biggest acquisition in India’s cement industry, require him to be involved in the “day-to-day affairs” of these investment entities and therefore be directly linked to the acquisition, as against Adani’s Hindenburg defence albeit in a different matter, which states that Vinod Adani being a related party has no relevance?

Vinod Adani and his wife Ranjanben being embedded 6 entities deep as the beneficial owners, where all parent entities own 100% of their child entities, is nothing but an attempt to obfuscate the Adani family connection.

In Adani’s Hindenburg response it is stated; “Amicorp is a recognized firm that provides secretarial services to various entities and corporate groups from across the globe and not just the Adani portfolio entities. More details for Amicorp and its portfolio are available at: https://www.amicorp.com/. “

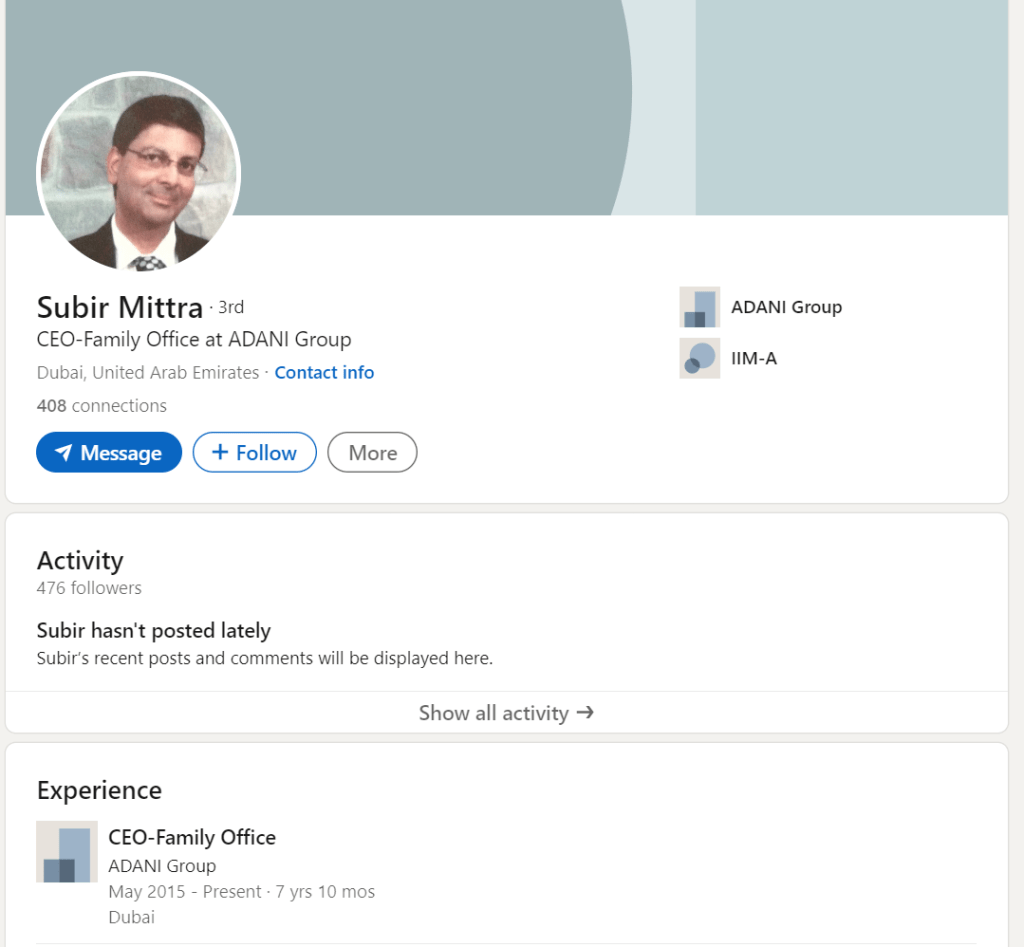

Subir Mittra is CEO Family Office at Adani Group, Ashwanee Ramsurrun is a former director at Amicorp Mauritius Ltd as per their respective LinkedIn profiles and Shakil Ahmed Toorabally is Managing Director at Amicorp Mauritius Ltd. also in an e-filing with the Mauritius Revenue Authority he is listed as the contact person for Amicorp Mauritius Ltd., extract below:

Subscriber ID: SNSVC01175

Subscriber Name: AMICORP MAURITIUS LIMITED

TAN Number: 4040210

TEL/Number:4040201

Email address: s.toorabally@amicorp.com

Contact Person: SHAKEEL TOORABALLY

Address: 6TH FLOOR,1 NEXTERACOM BUILDING, CYBERCITY EBENE

From the above its clear that directors in Amicorp Mauritius Ltd. are also directors in Xcent Trade and Investment Ltd. and Acropolis Trade and Investment Ltd, the investment company acquiring Ambuja and ACC. In all probability given none of these investment companies have a physical presence or operation in Mauritius, the company secretary is appointing one of their directors (so he is qualified to be a director) as the resident director. This further establishes these are not genuine investment companies but shell companies with no physical operations in it’s country of incorporation.

In a statement Adani officially stated “We are aware of a report from Bloomberg news claiming that Adani Group Chairman Mr Gautam Adani is considering opening a family office in Dubai or New York. There is no truth to this claim. Neither Mr Adani nor the Adani Family has any plan or is in consultations to open a family office overseas. It is extremely unfortunate that this baseless report by Bloomberg has triggered a flood of needless and avoidable speculation in the media,” said Adani Group in a statement.” However, Subir Mittra who is also a director in multiple offshore companies associated with Adani, unofficially claims to be the CEO of Adani Group’s Family Office in his Linkedin profile.

Adani gets Holderind, the holding company of Holcim to sign a Non-Disposal Undertakings or NDU with Barclays, Deutsche bank and 14 other banks to ensure they cannot transfer ownership of the shares. At the back of it, Adani pledges these shares to acquire a loan of $4.5 billion 69.2% of the acquisition value to enable the sale.

Furthermore, Holcim CEO Jan Jenisch explains while addressing investors; “So, according to our analysis, it is a tax-free transaction,”after the deal on Monday. When asked about the tax implications, he said: “Never know if any complication arises, but we assume that we will get the 6.4 billion Swiss Francs as net proceeds”. In order to demonstrate scale of tax losses, a broad strokes estimates would be as follows; given Holcim acquired Ambuja Cements at $1 billion, @21.86% Long Term Capital Gains (LTCG) tax, on an estimated LTCG of $ 5.92 billion, the tax loss to the exchequer on the sale of securities could be to the tune of $1.3 billion.

Conclusion: Adani MIAL acquisition

GVK was already in financial distress and was looking to sell their stake as they were struggling to meet debt obligations when Adani made a bid to acquire the GVK lead consortium’s stake in MIAL. Within 22 months of November 2019, when GVK blocked Adani’s acquisition of Bidvest with the support of a white knight, Adani acquired 74% of MIAL shares.

In the ensuing dramatic two and a half years starting March 2019, several unconnected parties conspire to make what was an impossible deal possible for Adani:

- In 7.5 months of Adani’s initial bid to Bidvest, a rather innocuous whistleblower report is filed, and an inspection of MIAL books of accounts is ordered by the MCA under the leadership of BJP minster Nirmala Sitharaman.

- 9 months after MCA’s investigation, CBI filed criminal cases and a month later ED conducted extensive searches of GVK and MIAL premises.

- Within couple of months of the CBI cases and ED search, GVK withdrew from the ADIA consortium deal and starts negotiating with Adani.

- 10 months from when the negotiation with Adani began ED filed chargesheets, this combined with suits filed by the Indian banks, tipped the scales.

- 2 months hence at the back of the combined assault on GVK and mounting legal fees GVK has no other option than to sell to Adani and the MIAL takeover is approved by the Central government.

- In January 2023 CBI withdraws all cases and GVK refuses to accept there was any arm twisting involved in the deal.

The truth is GVK was far from a thriving institution at the time of Adani’s bid. Given their inability to meet their debt obligations, they probably would have had to sell their stake to someone if not the Adanis. But the question is were the investigations meant to push GVK into selling to the Adanis. This is very hard for me to establish. All one can say is, relative to SEBI taking over 4 years to investigate Adani’s offshore connection, in the GVK case, the government’s investigative agencies moved at lightning speed to file cases and chargesheet (not necessarily spurious), only to curiously roll it back after the acquisition is complete. Also the timing strangely coincided with the events that lead to the acquisition. I am not one to believe in coincidences, but if I were to start, I can only imagine Adanis somehow found themselves in the goldilocks zone of deals, where regulators, financial institution and the judiciary came together to make an unlikely deal happen.

Conclusion: Adani Ambuja and ACC acquisition

There are incorrect allegations made of collusion with the government in the Ambuja and ACC acquisition, at least I could not find evidence of that. The only notable government intervention was the CIC fines which were imposed on 11 companies in 2016 years before the Adani acquisition bid that took place in 2022 and in fact these fines were upheld by the courts in 2018. So I believe these allegations are unsubstantiated.

However, this is a case of Adani using offshore shell companies to evade tax costing the exchequer tax money in the range of $1-1.3 billion, as openly admitted by the Holcin CEO. Through the SEBI letter of offer document, it is undeniable that the Adani’s Family Trust and Vinod Adani are behind these offshore shell companies acquiring Indian firms and far from arms length. While they deny the existence of a Family Office an ex-Dubai based private banker who is also a director in multiple Adani offshore companies claims to be the CEO for the group’s family office.

If indeed SEBI has been investigating the Adani offshore connection since 2019, they needn’t have gone farther than looking at the open offer document filed in the Ambuja-ACC acquisition to identify a clear pattern. While the Enforcement Directorate has sent show cause notice to 426 individuals with undeclared offshore holdings listed in the Panama papers, what do they do about publicly declared holdings in offshore companies specifically structured to avoid tax? This seems to be possible on account of gaps in the regulatory framework which companies like Adani openly exploit.

It’s also clear that Adani acquired the company with money they didn’t readily have through clever financial engineering that involved pledging shares. But did Adani do anything illegal? I believe that’s for a legal expert to determine, but prima facie, based on their disclosures, it seems unlikely. This is why Adani’s repeated denial of plain facts and mixed communication is all the more perplexing. All of this gives me reason to feel the need for an investigation if not for anything at least to restore market confidence.